Own Your Numbers: Creating Financial Projections for Investment Presentations

June 16 @ 12:00 pm - 2:00 pm

Free – $25

We’re running this workshop as an ONLINE event via Zoom. We’ll email the Zoom link and the workshop materials to all the registrants shortly before the event starts. Any questions, please email [email protected]

Financial Projections are key in all aspects of the startup fundraising process: Pitching, Valuation, Due Diligence, and in the long-term planning of your company. Investors want to see cold, hard numbers, predicting your financial performance 3 -5 years down the road, but it could be a difficult task for the founder, especially if you’re just starting out.

Join our experts for an engaging and practical workshop to help you iron out your financial projections and learn the key metrics that will get investors to notice you. With the expert advice of investors and financial experts, we’ll walk you through the process of creating and calculating your financial projections. If you have no or little idea where to begin with your financial projections, this program is for you.

By joining this workshop, you will:

- Have a better understanding of the important numbers of your business: Revenue, COGS, Operation Expenses, Gross Profit, Gross Margin, EBITDA, etc.

- Have a thorough understanding of your company’s business model

- Use an online tool and template to build your revenue model

- Learn how to communicate your financial projections effectively and tell a compelling story of your business to investors

- Get real-time feedback from our instructors

- Get access to recording, slides, and lists of practical tips and useful resources

Instructors:

Johnnie Walker

Co-Founder at Rooled

Johnnie Walker was previously VP Sales with inDinero, providing fully outsourced accounting solutions to start-up, emerging high-growth and established companies. He led sales and BD activities nationwide for the company. inDinero acquired tempCFO in 2018, where Johnnie led the East Coast office and provided strategic CFO advisory services to technology ventures and other businesses.

Johnnie was previously Director of Finance at A-List Education where he led the re-structuring of the finance infrastructure to support growth in the college education services business. Prior to A-List, he was Consulting Director of Finance at Echoing Green, where in addition to managing the organization’s financial systems he also led all impact investing activities, developing the Recoverable Grant investment concept and leading the structuring of the partnership with The Social Entrepreneurs’ Fund.

Johnnie lectures on impact investing at Columbia Business School also advises a number of start-up businesses, focusing on financial management and investment strategy.

Lisa Frusztajer

Investor in Residence of The Capital Network, Investment Committee at Portfolia, Angel Investor at Pipeline Angels and Next Wave Ventures

Lisa Frusztajer is the Investor in Residence of The Capital Network. She focuses on early-stage investing as an angel investor. She’s on the Investment Committee at Portfolia, an Angel Investor at Pipeline Angels and Next Wave Ventures and a Venture Partner at Converge Venture Partners.

She started her career with Sun Microsystems, then helped grow a small software startup called KYOS, then joined Avid Technology, the leading provider of audio and video technology for media organizations and independent professionals. Lisa’s background is an eclectic blend of marketing, engineering and project management, as well as of technology, manufacturing, higher education and finance.

Lisa holds an AB from the University of Chicago, a MS from the London School of Economics, and an MBA from Columbia Business School.

Ian Mashiter

Curriculum Director for Innovate@BU at Boston University

Ian Mashiter is the Curriculum Director for Innovate@BU, which he established as BU’s center for entrepreneurship. Previously, Ian was an entrepreneurial executive with more than 28 years of high technology experience. Over his career, Ian has served as a board member, chief executive officer and co-Founder of such innovative companies as Quarry Technologies, Ennovate Networks, Dymec Kinetic. Nimbit and BMS. He is also an angel investor with Launchpad Venture Group where he evaluates business plans for potential investment and provides advice to portfolio companies.

Useful Resources to Help You Get Ready for the Workshop

Please note:

- By joining any of The Capital Network’s (“TCN”) webinar events, you are agreeing to TCN’s Webinar Recording Disclaimer and Restrictions, which can be found HERE.

- TCN events are open to entrepreneurs and investors only, or approved guests of TCN. Service providers of any type must join TCN as a Sponsor. Email [email protected] for details.

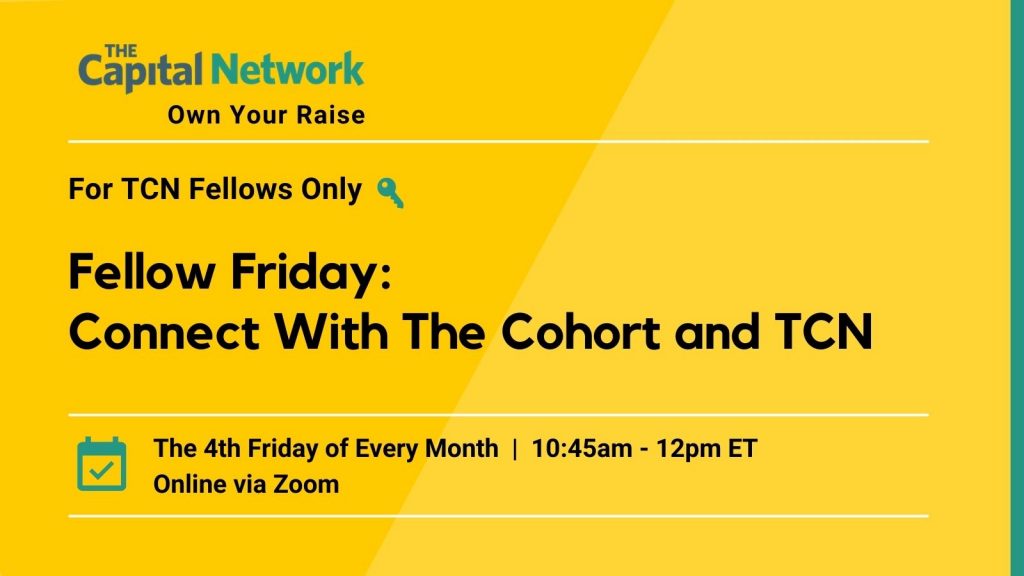

Related Events

Join as a member Want unlimited access to everything The Capital Network has to offer?

Join as a member for access to events and more.